|

On Thursday, March 11, President Biden signed the $1.9 Trillion American Rescue Plan ("ARP") into law. The use of Budget Reconciliation allowed a narrow majority in the Senate (50-49) to enact the legislation. Also, any effort to raise the federal minimum wage to $15 was dropped.

What are the immediate ARP opportunities for French and foreign businesses? Anti-COVID: As the U.S. passes 100 million vaccinations and at 2 million per day, is on its way to 200 million by the end of June, the U.S. will use at least $60 Billion in ARP funds to continue the fight against COVID. When we add this funding to the $400 Billion in direct checks of $1400 each to persons making up to $75,000 per year or $150,000 per couple, the basis for continued economic recovery is established. The boost from spending under the ARP is forecast to support 8% growth in GDP (PIB) in 1Q 20212 and over 6.5% for the year 2021. Meanwhile, the EU, including France, “ lags behind the U.S. in its COVID recovery” (Wall Street Journal 03/13/21) and by consequence, in its economic recovery efforts, whether measured by growth in GDP (PIB), hospitalizations, deaths per capita, or vaccinations. This means that the U.S., the largest Western economy, is more than ever an attractive target for foreign investment, whether by establishing a new U.S. subsidiary or entering the market through an acquisition or joint venture. Stimulus Spending: The ARP contains additional government spending that creates new markets that foreign and domestic businesses can capture to sell their services, technologies, and products. Unlike past stimulus legislation, the ARP will send over $155 Billion directly to local governments, bypassing the States and bureaucratic red tape. Cities, towns, and counties will want to spend those dollars quickly, particularly for new equipment, technology, and services. This will create a boom for companies with a local presence that can cash in. Schools likewise will receive $170 billion in federal funding to spend as they like to reopen, or modernize and make safe their facilities. A special Restaurant Fund of $28 billion in the ARP will allow restaurants to apply for grants to reopen or transform their facilities, using the latest in products and technologies. And the list goes on... Meanwhile, President Biden announced that the ARP is "just the beginning" as he gets ready to submit a trillion dollar+ (1000 billion+) infrastructure and climate change plan to Congress. His "Build Back Better" will push clean energy, EVs (electric vehicles), and other green projects along with repairs and improvements to the infrastructure (everything from more 5G to tunnels and bridges, etc.). We expect that if Build Back Better is to pass Congress, President Biden will need to offer a "sweetener" or inducement to each Republican Representative or Senator -- namely an opportunity to sponsor special projects for his or her home district. A return to the "horse-trading" in "Earmarks'' from years gone by? Please stay tuned for more developments. We would be happy to discuss with you how your company could capitalize on the ARP's huge and unprecedented expenditures. With Best Regards, Eliot

0 Comments

February 4th Webinar: Biden Economic Programs' Impact on Foreign Direct Investments and M&A2/9/2021 Bonjour Tous et Toutes, Hello Everyone,

We wish to thank you for your interest, registration or participation. We had a large number of attendees even though 6:00 pm was after the curfew in France! We have received a number of requests for the slides and a recording of the "Spéciale Post Elections Américaines Table Ronde." For your convenience we have posted the video recording of the webinar and the slides at the following links: Video: https://youtu.be/j-1ilAFIz4w Slides: https://bit.ly/3pSfh6P We plan to update our information about the American Rescue Plan, Build Back Better, and President Biden's Buy American regulations. With your permission, we will send you alerts as these programs become law or are finalized over the months to come, starting with the American Rescue Plan in March, 2021. We wish to thank the participation of Emmanuel Denoulet from Bpifrance's International Build-up Fund, Marc Trost from Orbiss on taxes, and the insights of Olivier Attia and the team on preparing and negotiating an M&A Deal and the importance of a market study that takes into account Post-Covid trends. We also wish to thank Natacha Lalande at EACC for her organization of this event in partnership with Roland Cathebras at the LYON PLACE FINANCIERE & TERTIAIRE.If you are not yet a member, I would encourage you to consider joining the EACC by contacting Natacha or the LPFT by contacting Roland at [email protected]. We are members and we find that we benefit greatly from the organizations' activities. Questions, comments, requests for information: please contact Natacha at [email protected] or [email protected]. For your convenience, we have also enclosed a Request for Confidential Consultation form, which can be accessed by clicking the following link: Confidential Consultation Form: https://lp.constantcontactpages.com/su/m2cw3RB/consultation With Kindest Regards, Eliot Norman The land and infrastructure deal space has been one of the few bright spots across all sectors given the effects of COVID-19. United States Q2 Deal Volume for the sector fell 16% over Q2 2019, which was the second-lowest decline across all sectors. Hospitality and Oil & Gas were two of the hardest-hit sectors, with their deal volumes declining 50% over the same period. With investors constantly seeking for distressed opportunities in the short-term, and with many investors currently holding onto a lot of dry powder, deal activity will assuredly increase in the near future.

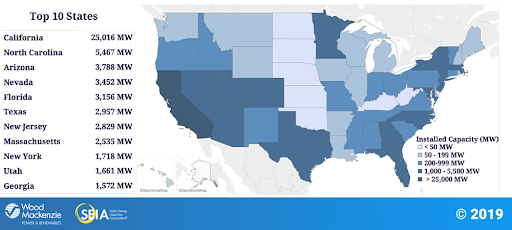

Another positive for the industrial real estate space is that CMBS loan delinquencies are below 1.0%, per Fitch Ratings. Other areas like hotels and retail have delinquency percentages of up to 11.5%. This signifies strength and confidence in the industrial space, and when that is combined with forthcoming reductions in governmental aid, there is a remarkable opportunity for investors to provide capital and increase deal flow. One senior vice president, Robbie McEwan, at Coldwell Banker Richard Ellis (CBRE), one of the largest land brokers in Florida, has stated that he’s seen five to ten times the amount of calls inquiring about buying land this summer when compared to last summer. Investors are rushing towards land deals to place their money in safe assets during the current economic uncertainty driven by COVID-19. Investing in land is a great asset to invest in as its taxes are typically low and its value tends to rise. Near McEwan’s area, property market value has risen 6.3% in just the last year in Orange County, FL. The time is currently ripe for land and infrastructure deals, and keen investors are taking advantage of investing money during the current dip in valuations across the board in the United States. Sources: PWC, Orlando Business Journal The President has taken unprecedented action to block issuance of new business visas, long relied upon by foreign corporations and individuals doing business in the United States. The ban includes employment-based immigrant visas, L-1 transfers for managers and executives and H-1Bs, among other categories. The details are many and complex. However, one thing is crystal clear. This Administration will not block and will actually favor visas for foreign investors who create jobs for Americans. The EB-5 Green Card Program does that. To learn more about how you can apply and how the EB-5 can help you and your family emigrate to the United States by making an investment in a qualifying real estate or other development project, please watch our One Minute Briefing on EB-5 Basics. For many, the EB-5 is now the best choice for an investor, his or her spouse, and their children to permanently reside in the United States. Thank you. Eliot Norman, Esq. [email protected] Juline Kaleyias EB5 Capital [email protected] Corporate New Office & Greenfield Projects carry risks if they are too dependent on L-1 transfers and H-1B immigration of key foreign personnel to the USA. Foreign companies hoping to catch the rebound of business in the United States in 4Q 2020 and 1Q 2021 should focus again on using Cross-Border M&A Deals and Joint Ventures to acquire market share and grow their U.S. business. Why? When you "Americanize" your business. you have less risks of disruption to foreign supply chains, which include goods, services, technologies and human capital. For more information see our research and analysis of U.S. M&A opportunities in solar energy and other industry sectors at transatlanticpartners.org. Thank you. #mergersandacquisitions

YESTERDAY President Trump did it again. He Extended and Broadened His 60-day Suspension of "Entry of Alien Workers Presenting a Risk to the U.S. Labor Market" from June 24, 2020 to December 31, 2020. The highlights: The previous Ban on most Businesses and Family Immigrants will continue without change. Notable Exceptions: EB-5 Investment Visas that are intended to create 10 Jobs per Investor. See Analysis below in our Video featuring J. Kaleyias from EB-5 Capital and Eliot Norman, Esq. What's new? President Trump extends his Ban for the first time to nonimmigrant or temporary business and work visas. These include new visas for L-1s for International Corporate Transfers, the H-1B for professionals, the H-2B for seasonal workers and J-1 interns and trainees. Principal exceptions: existing visa holders, workers needed to fight Covid-19, or who are essential to the food supply chain. U.S. investment visas (E-2 and EB-5 Green Cards) remain exempt. Conclusion: The Suspension's unprecedented "assault" on business visas means that companies who want to grow sales and profits in the United States should invest here. See transatlanticpartners.org for our research and analysis of Cross-Border M&A Deals and their importance to capturing market share in the U.S.A. Rapid Expansion of U.S. Market for Horticulture Lighting

Philip James, Partner, TRANSATLANTIC Partners LLC [email protected] The overall horticulture lighting market is expected to grow from $2.43 billion in 2018 to $6.21 billion in 2023, a CAGR of 20.61%. Here are some key highlights:

The target key customers for this business are:

BUSINESS Wind, Solar Farms Are Seen as Havens in Coronavirus Storm Steady returns in renewable energy attract investors, even as new projects likely face finance hurdles PHOTO: JACK KURTZ ZUMA PRESS View the full article on the Wall Street Journal Here HERE By Russell Gold Updated March 31, 2020 11:47 am ET Wind and solar farms are attracting interest from investors hungry for low-risk, stable-yield opportunities at a time of extraordinary market volatility. That interest is a boon for renewable projects, and could give them a financial boost in coming months and years. However, developers could face challenges in getting additional new projects financed and built amid the turmoil created by the new coronavirus. It might seem an odd time for a renewable-energy uptick, given the economic slowdown and a historic crash in oil prices that is making fossil fuels cheap. But wind and solar farms experienced a similar surge after the 2008 financial crisis, when investors seized on the projects as safe-harbor investments with yields in the mid-single-digit percentages. Wind and solar farms have contracts to sell their electrical output to utilities and companies with good credit ratings for a decade or longer, making their returns stable and relatively low risk. “There is certainly some increased interest and discussion around uncorrelated yields, and renewables falls into that category,” said David Giordano, global head of renewable power at BlackRock Inc. “As I’m trying to stock my cupboard with canned goods, we have an awful lot of calls happening.” The increased interest is fortuitous for renewable-energy builders such as Kevin Smith, chief executive of the Americas at Lightsource BP, a solar developer half-owned by British oil giant BP PLC. On March 12, he signed a deal with banks to finance a $250 million solar project in North Texas, even as the Dow Jones Industrial Average ended the day down 2,352 points. “It was a strange day,” Mr. Smith said. He said he expects to close a further $750 million in solar financing this year, including a large solar farm in Colorado. “I’d like to think that there will be more investors from infrastructure funds looking at renewable markets as a safe haven from the volatility,” he added. Corporations contracted for 46% of the 20.2 gigawatts of renewable energy added to the U.S. grid last year, according to the Renewable Energy Buyers Alliance, a group that represents corporate purchasers. The largest buyers last year were Facebook Inc., Alphabet Inc. unit Google and AT&T Inc. Corporations have been contracting for renewable energy because prices are low and because many have made pledges to lower their carbon output. “No one has yet indicated that they intend to slow their purchase,” said Miranda Ballentine, the group’s CEO. Still, finishing existing projects, much less building new ones, might prove difficult. Developers could face some significant hurdles in coming months, including shortages of labor and specialized tax-equity financing. The U.S. industry relies on tax credits. Renewable-energy lobbying groups are seeking relief from Congress, either in the form of cash grants instead of tax credits, or extensions to allow delayed projects to still qualify for credits. But renewable-energy projects weren’t included in the $2 trillion coronavirus stimulus bill, and it isn’t clear any assistance is forthcoming. For now, deals are continuing. Only 4% of near-term deals have requested delays, said Bryce Smith, CEO of LevelTen Energy Inc., an online marketplace that connects buyers and sellers of renewable energy. “These are long-term investments,” he said. Supply contracts can last from 10 to 15 years. Earlier this month, the Tennessee Valley Authority solicited proposals to build 200 megawatts of wind or solar power. It said it expects to sign a contract with the winning bidder in September. “If you have a project in the chute, and you are working toward a closing in the next week or month, or months, my guess is that those projects get done,” said Paul Gaynor, CEO of Longroad Energy, a Boston-based renewable developer. “For projects that are expecting to enter the finance market in the second half of 2020, I think it’s a total toss-up right now if it gets done.” Once completed, demand for wind and solar farms is as strong as before the spread of the coronavirus, and maybe stronger. In the years after the 2008 financial crisis, infrastructure investors’ appetite for wind farms in particular rose rapidly as they chased better yields. That enthusiasm helped drive the rapid growth of the industry, which took off after the economy began recovering in 2010 and kept rising. In 2009, wind and solar generated 1.9% of U.S. electricity, according to Energy Department statistics. A decade later, they accounted for 9.9% of the nation’s power. Investor interest in stable yield could again rise and drive additional growth in the sector. A solar farm can generate about a 7% yield, according to several people involved in financing these deals. “Renewable-power generation is largely uncorrelated to oil and natural-gas markets, which further strengthen their overall appeal, and may well be one of the first assets classes to unfreeze,” said Keith Derman, co-head of Ares Infrastructure and Power at Ares Management Corp. Write to Russell Gold at [email protected] View the full article on the Wall Street Journal Here HERE U.S. Solar Project Basics |

Archives

March 2021

Categories |