CURRENT OPPORTUNITIES

|

As savvy investors, it is crucial to know which industry sectors make sense when buying a small U.S. business in the price range of $350,000-$1 million going forward into 2021. These acquisitions can also be used to obtain E1/E2 or other investment visas for you and your family if you are a foreign national looking to move to the U.S.

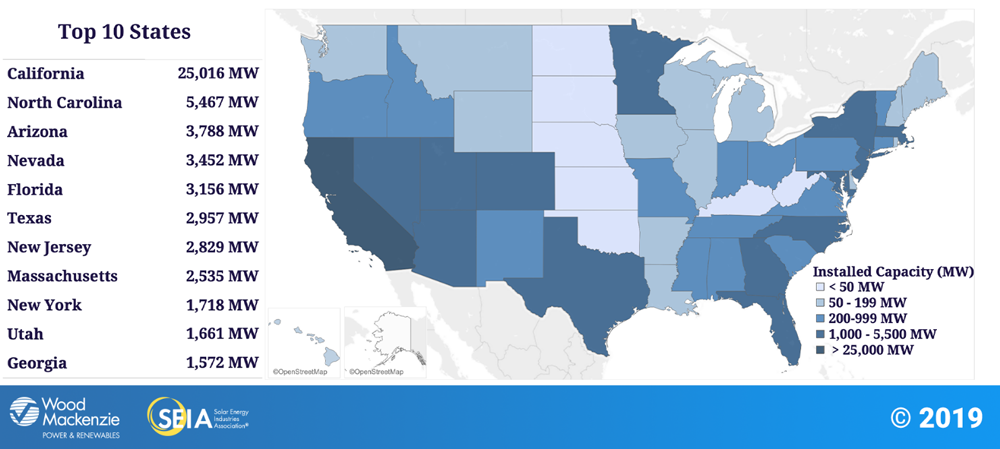

Regardless of the choice of industry or the size of the deal, three important points remain: be flexible, be knowledgeable, and align yourself with a professional. To these, I would add the importance of being able to PIVOT if plans change. Finally, consider buying a 50% stake in a business, giving the owner incentives to stay on and fully integrate yourself into their operations and the market, with a provision for buying full control in 1-3 years. This is particularly important if you have not done business in the USA before or are unfamiliar with the business or the industry. Sellers typically offer help with refinancing, otherwise, federal Small Business Administration (“SBA”) loans can be a viable alternative. For foreign buyers, it may be possible to borrow against foreign assets for use in making a U.S. acquisition. The market for deals under $1 million continues to grow in sectors that are doing well in weathering the limitations of COVID-19. However, some of the growth may not continue at the same pace as the economy begins to recover. What investors need to consider are the changes in the ways that companies and individuals will do business, for example, relying more and more on virtual shopping and technologies that best adapt to business changes. Here are the 10 sectors that should be considered when deciding on smaller M&A deals in the U.S. market in 2021: 1. Virtual Health/Home Healthcare: Healthcare has transitioned from just being located at hospitals and doctors’ offices to people’s own homes. With the increased personal attention, efficiency, and clinical outcomes through home-based telemonitoring, it is no surprise that telemedicine has increased greatly. Second, the need for home healthcare has accelerated. COVID-19 is placing more emphasis on care in the home than in institutions and home health care agencies are seeing increased demand for their services. 2. Last-Mile Distribution/Delivery Services: This kind of business is easy to manage for investors and presents a huge opportunity as major companies like Amazon and Walmart have transitioned to using last-mile delivery and distribution services to complete their orders since it expedites their process and reduces their costs. These centers are also becoming popular among grocery stores that want to prevent spoilage of goods and increase delivery speed to their customers who are now ordering more grocery-deliveries than ever before. 3. Home Improvement: With increased time spent at home, people are moving towards more self-sustainability efforts and revamped homes. Home improvement activities have seen significant increases and look to remain hot as the work landscape transitions to including work from home going forward. 4. Pet Services and Products: Crazy statistic: When unemployment increased above 10%, pet adoptions increased by 10%. In today’s landscape, pet adoption and subsequent pet product purchasing have increased substantially. 5. Water/Air Filtration Systems: Water filtration systems and air-purifying systems are extremely hot right now as residential houses and commercial and office buildings seek to improve health standards. There are many small businesses looking to sell in this area right now. The quality of air distribution systems in office space and other workplaces and restaurants is a major concern as they reopen. 6. Home Beauty Products: Shift towards consumers being very comfortable completing their own self-care routines in haircare and skincare. Wellness alternatives and home beauty kits have seen major growth. 7. Bikes and E-Scooters: Increase in sales of bikes, e-scooters, and similar forms of transportation as people look to avoid public transportation. Bikes and e-scooters are also seen as healthy forms of exercise, and so their recreational use has also seen an increase due to COVID-19 and looks to remain strong post-COVID. 8. Liquor/Alcohol/legalized Marijuana: Home alcohol consumption has risen greatly during the pandemic and is expected to maintain its current level post-COVID. Small business liquor stores are ripe for acquisition in the right areas for the right prices. Increased legalization of cannabis and marijuana and increased consumption presents another opportunity as well as the LED lighting required for growing. 9. Residential Construction: Residential construction increased 17.3% in June following double-digit declines in previous months as a result of the pandemic. New home sales are already above pre-recession levels. More families are considering permanent relocation from high-cost and health hazardous metropolitan areas as they realize they can work remotely in an effective way. Focus is on high value real estate construction and deals, localities 50-100 miles from major metropolitan areas. 10. Trucking Supply Chains: Commercial trucking continues to be the way a majority of freight is transported in the United States. Technologies that improve trucking logistics are always needed and have the potential to be especially lucrative in current times with increased shipping since people prefer to stay at home. TRANSATLANTIC PARTNERS LLC offers a number of opportunities in the solar energy sector. These include purchase of majority interests in solar development companies, purchase of individual projects, and financing of companies seeking credit facilities to expand. Investment opportunities range from $5 MM to $25MM. We are also actively interested in acquiring solar properties, including purchase of land with existing solar facilities and land for lease for utility scale solar projects.

For further details, please contact: Eliot Norman President US +1 (804)-721-7851 [email protected] TRANSATLANTIC Partners LLC focuses on helping European companies expand into the United States through M&A deals and Joint Ventures. |

U.S., U.K. and French Companies for SalePlease view 'Previous' or 'Archives' to see older listings Archives |