CURRENT OPPORTUNITIES

|

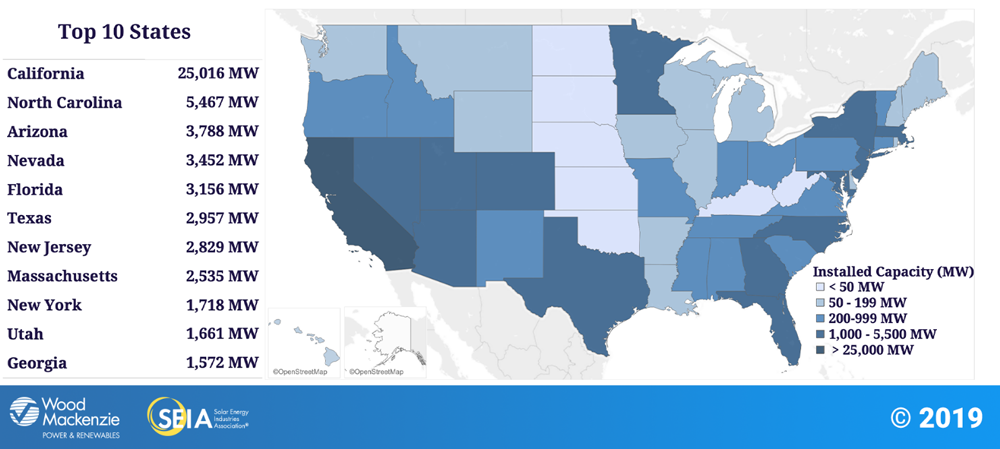

TRANSATLANTIC PARTNERS LLC offers a number of opportunities in the solar energy sector. These include purchase of majority interests in solar development companies, purchase of individual projects, and financing of companies seeking credit facilities to expand. Investment opportunities range from $5 MM to $25MM. We are also actively interested in acquiring solar properties, including purchase of land with existing solar facilities and land for lease for utility scale solar projects.

For further details, please contact: Eliot Norman President US +1 (804)-721-7851 [email protected] TRANSATLANTIC Partners LLC focuses on helping European companies expand into the United States through M&A deals and Joint Ventures.

1 Comment

3/3/2022 07:25:22 am

Happy to discuss companies to buy or sell; or projects to buy or sell

Reply

Leave a Reply. |

U.S., U.K. and French Companies for SalePlease view 'Previous' or 'Archives' to see older listings Archives |